unlevered free cash flow yield

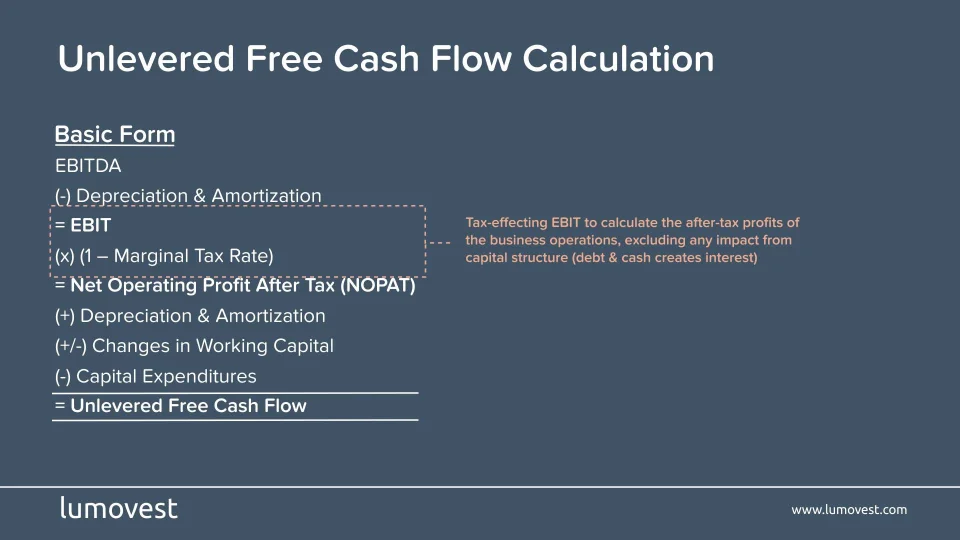

Based on whether an unlevered or levered cash flow metric is used the free cash flow yield denotes how much cash flow that the represented investor groups are collectively entitled to. This measure is unlevered meaning it does not take into account the companys debt burden.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

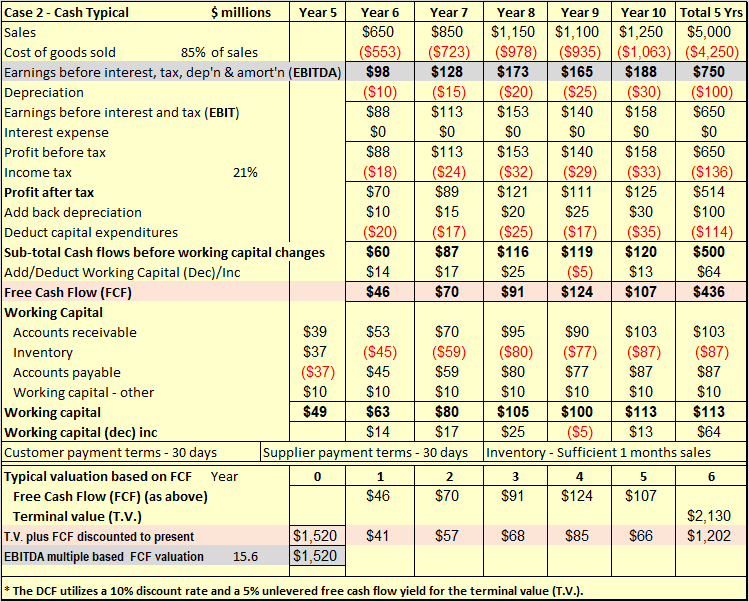

UFCF EBITDA - CapEx - Changes in WC - Taxes.

. It showcases enterprise value to debtholders with a stake in the companys financial wellbeing. FCF Yield Unlevered Free Cash Flow Total Enterprise Value Applying this formula Amgens FCF Yield is calculated below. Unlevered Free Cash Flow - UFCF.

The key point here is this. Get the tools used by smart 2 investors. Calculating Free Cash Flow Yield.

Unlevered Free Cash Flow EBITDA CAPEX Working Capital Taxes. To fully understand and successfully execute the unlevered free cash flow formula its crucial that you have a good grasp of the following definitions. When filing the financial statement of a company UFCF are also reported.

This is the money that a company has before. The capital might for example be used to pay down obligatory debt obligations. Hence using unlevered cash flow gives a much better estimate of the value a business generates by avoiding the effects of its capital structure.

Free cash flow yield is meant to show investors how much free cash flow a company generates relative to the value of its sources of funds. Where UFCF Unlevered free cash flow. To break it down free cash flow yield is determined first by using a companys cash flow statement subtracting capital expenditures from all cash flow operations.

Unlevered Free Cash Flow 10327 B Total Enterprise Value 1565 B FCF Yield 66. UFCF is calculated as operating cash flow minus capital expenditures. Then the free cash.

The formula to calculate UFCF is. Unlevered free cash flow yield. It demonstrates the amount of remaining cash that might be used to benefit all capital sources debt and equity.

The unlevered FCF yield indicates the companys overall operational performance. Unlevered cash flow is the cash produced by a property before any loan payments are made. Unlevered free cash flow UFCF refers to the money available to a company without interest payments.

Unlevered Free Cash Flow Operating Income 1 Tax Rate Depreciation Amortization - Deferred Income Taxes - Change in Working Capital Capital Expenditures Why do we ignore the Net Interest Expense Other Income Expense Preferred Dividends most non-cash adjustments on the Cash Flow Statement most of Cash Flow from Investing and all of Cash. Unlevered free cash flow UFCF is a measure of a companys ability to generate cash flow from its operations after accounting for capital expenditures. Unlevered free cash flow can be reported in a companys.

Unlevered free cash flow is generated by the enterprise so its present value like an EBITDA multiple will give you the Enterprise value. Westburys latest twelve months unlevered free cash flow yield is not meaningful. LFCF yield measures LFCF against the value of equity while UFCF yield measures UFCF against enterprise value.

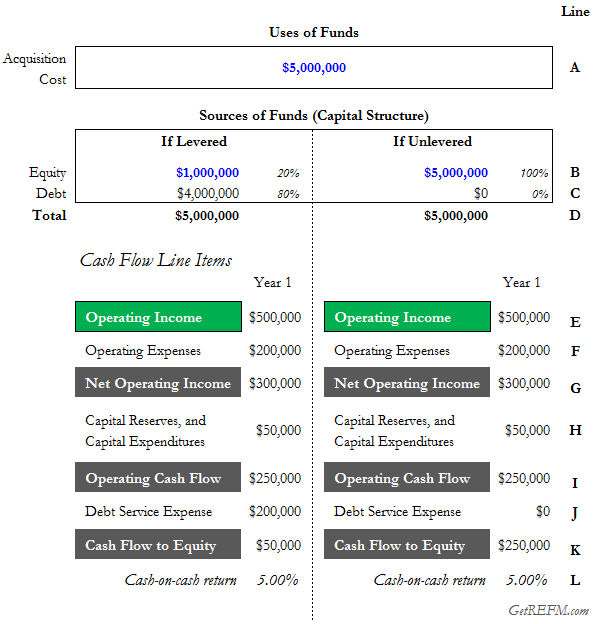

Unlevered free cash flow is usually only visible to financial managers and investors rather than to the average consumer. Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account. At 1244 the levered IRR is higher even though the annual cash flows are lower.

In addition the average cash-on-cash return of 2360 is higher due to the financial leverage placed on the property. Unlevered free cash flow is used in DCF valuations or debt capacity analysis in highly leveraged transactions to establish the total cash generated by a business for both debt and equity holders. Unlevered Free Cash Flow UFCF Formula.

The calculation of free cash flow yield is fairly simple. Unlevered Free Cash Flow Formula. Unlevered free cash flow is a theoretical dollar amount that exists on the cash flow statement prior to paying debts expenses interest payments and taxes.

Free cash flow yield is really just the companys free cash flow divided by its market value. Free cash flow yield is a ratio wherein a fcf metric is the numerator and the total number of shares outstanding is the denominator. The formula to calculate unlevered free cash flow UFCF is as follows.

The formula that is used in order to calculate unlevered cash flow does not take into account debt or any payments that have to be made in order to settle the debts. UFCF EBITDA - CAPEX - Working Capital - Taxes. LFCF yield is calculated as levered free cash flow divided by the value of equity.

What is Unlevered Free Cash Flow Yield. Free Cash Flow Yield UFCFY measures amount of free cash flow for each dollar of total enterprise value. It is the cash flow of a company based on the belief that the company owes no debt therefore has no interest payments to make.

View Westbury Bancorp Incs Unlevered Free Cash Flow Yield trends charts and more.

What Is Free Cash Flow Calculation Formula Example

Free Cash Flows Let S Have A Discussion Towards A Better Understanding Seeking Alpha

Unlevered Free Cash Flow Ufcf Lumovest

Fcf Yield Unlevered Vs Levered Formula And Calculator

60 Second Knowledge Bite Levered Vs Unlevered Cash On Cash Returns Real Estate Financial Modeling

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

Unlevered Free Cash Flow Definition Examples Formula

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Fcf Yield Unlevered Vs Levered Formula And Calculator

:max_bytes(150000):strip_icc()/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow Yield Formula Top Example Fcfy Calculation

What Is Free Cash Flow Calculation Formula Example

Free Cash Flow Yield Explained

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial